The 10-Minute Rule for Insurance

Wiki Article

Not known Details About Insurance

Table of ContentsGetting My Insurance To WorkThings about InsuranceThe smart Trick of Insurance That Nobody is Talking AboutInsurance for DummiesSome Ideas on Insurance You Need To KnowThe Insurance Ideas

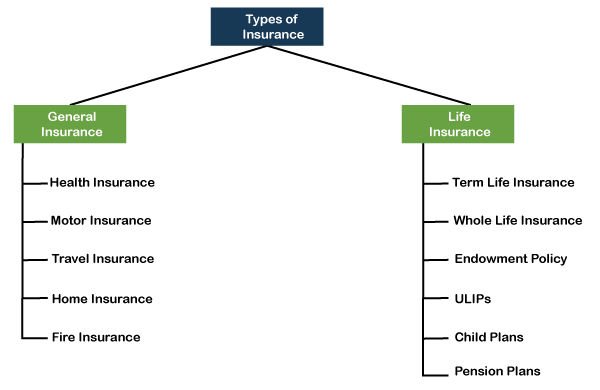

While we generally can not prevent the unforeseen from happening, occasionally we can obtain some security. Insurance is implied to secure us, a minimum of financially, must specific points happen. There are many insurance policy alternatives, as well as numerous financial experts will state you require to have them all. It can be difficult to identify what insurance coverage you actually require.Elements such as children, age, way of living, as well as employment advantages contribute when you're constructing your insurance policy profile. There are, nonetheless, four kinds of insurance coverage that the majority of financial experts advise we all have: life, health and wellness, automobile, as well as long-term special needs. 4 Sorts Of Insurance Policy Everybody Demands Life Insurance The best benefits of life insurance policy consist of the capability to cover your funeral expenditures and also give for those you leave - Insurance.

The research likewise discovered that a quarter of families would experience monetary challenge within one month of a wage income earner's death. Simply explained, entire life can be used as a revenue tool as well as an insurance instrument.

The Best Guide To Insurance

Term life, on the other hand, is a plan that covers you for a set quantity of time. There are other significant distinctions between both sorts of insurance, so you may intend to seek the advice of an economic expert prior to you decide which is best for you. Elements to consider include your age, line of work, as well as number of dependent children.

, one in 4 workers going into the workforce will become handicapped and also will certainly be unable to function prior to they reach the age of retired life.

While medical insurance pays for hospitalization as well as medical expenses, you're still entrusted those day-to-day costs that your paycheck usually covers. Lots of companies provide both short- and long-term special needs insurance coverage as component of their benefits bundle. This would be the very best option for securing economical special needs insurance coverage. If your employer doesn't offer long-term coverage, below are some points to take into consideration prior to acquiring insurance coverage on your own.

Insurance for Dummies

25 million police reported cars and truck mishaps in the United States in 2020, according to the National Highway Traffic Safety And Security Administration. An estimated 38,824 individuals died in auto accident in 2020 alone. According to the CDC, vehicle click for info crashes are among the leading causes of fatality around in the United States and all over the world.3 million vehicle drivers and passengers were injured in 2020. In 2019, financial expenses of fatal auto crashes in the US were around $56 billion. While not all states need drivers to have auto insurance policy, most do have policies pertaining to financial responsibility in case of a mishap. States that do need insurance policy conduct periodic arbitrary checks of vehicle drivers for proof of insurance coverage.

How Insurance can Save You Time, Stress, and Money.

Once again, as with all insurance coverage, your individual situations will figure out the cost of auto insurance. To ensure you get the right insurance coverage for you, compare numerous rate quotes and the insurance coverage supplied, and also inspect periodically to see if you get lower rates based upon your age, driving record, or the area where you live.

Life will toss you a contour ball there's no doubt concerning that. Whether you'll have insurance policy when it does is an additional issue entirely. Insurance policy barriers you from unforeseen costs like medical expenses. And also while most people know that insurance coverage is very important, not every person understands the various kinds of insurance coverage available and how they can aid.

A Biased View of Insurance

kids). Those with dependents In case of death, a life insurance policy policy pays a beneficiary an agreed-upon quantity of cash to cover the expenses left by the deceased. A beneficiary is the person or entity called in a plan that receives benefits, such as a partner. Keep your home as well more as keep its property value high, plus be covered when it comes to significant damages, like a residence fire.In truth, several landlords need it. Lessees Occupants insurance policy is used by renters to cover personal effects in situation of damage or theft, which is not the duty of the property owner. Planning to jet off to a new destination? Then see to it the price of your airfare is covered in case of medical emergencies or various other incidents that may trigger a journey to be stopped.

Paying into pet insurance policy web might be more economical than paying a lump amount to your veterinarian need to your animal need emergency situation medical therapy, like an emergency clinic check out. Pet proprietors Pet dog insurance (primarily for dogs and felines) covers all or component of vet treatment when a pet is injured or ill.

Some Known Facts About Insurance.

Greater than 80% of uninsured respondents that had an emergency either might not afford the costs or called for six or more months to pay off the bills. While Medicare and also Medicaid recipients were the least likely to need to spend for emergency expenses, when they did, they were the least able to manage it out of the insured populace.Report this wiki page